Module 6.a: 8(a) Social Disadvantage Narrative

Intro

The Small Business Administration recently established a new rule that requires all 8(a) participants, including those who were previously admitted to the program under the presumption of social disadvantage, must now submit a social disadvantage narrative.

The social disadvantage narrative must be written in the first person and must be signed by the individual(s) who are claiming social disadvantage.

The social disadvantage narrative must include the following information:

- The individual's objective distinguishing feature(s) that make them socially disadvantaged.

- The ways in which the individual's social disadvantage has been rooted in treatment experienced in American society.

- The chronic and substantial nature of the individual's social disadvantage.

- The ways in which the individual's social disadvantage has negatively impacted their entry or advancement in the business world.

The social disadvantage narrative must be submitted to the SBA in a format that is consistent with the SBA's regulations.

The SBA has provided guidance on how to write a social disadvantage narrative. The guidance can be found on the SBA website.

The new rules for the SBA 8(a) social disadvantage statement went into effect on August 23, 2023. 8(a) participants who have not yet submitted a social disadvantage narrative should do so as soon as possible as they are due within 45 days.

Here are some additional things to keep in mind about the new rules:

- The SBA will not accept social disadvantage narratives that are submitted after the deadline.

- The SBA may request additional information from 8(a) participants who submit social disadvantage narratives.

- The SBA may deny an 8(a) participant's application if the SBA does not find that the participant is personally and actually socially disadvantaged.

- The deadline for submitting a social disadvantage narrative is 45 days after the date of the SBA's communication to the 8(a) participant. The SBA sent out communications to all current 8(a) participants on August 21, 2023. Therefore, the deadline for submitting a social disadvantage narrative is October 6, 2023. However, the SBA has said that it will accept social disadvantage narratives that are submitted up to 90 days after the deadline. This means that the SBA will accept social disadvantage narratives that are submitted by January 4, 2024.

If you have any questions about the new rules for the SBA 8(a) social disadvantage statement, you should contact an attorney who specializes in government contracting law.

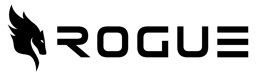

Why AI?

Experiencing discrimination or other objective social disadvantage can be a traumatizing experience, recounting that experience in sufficient detail for the SBA to justify your claim of disadvantage can be even more traumatizing. Does AI know your disadvantage? No. Can AI act as a scribe to document your experience in the required format to reduce your doing so? Yes. If that is useful for you, here is a way to leverage the tools.

I. Setup

Sign in to / up for Chat GPT and turn off the memory, if you would rather not have your personal information saved by ChatGPT.

https://www.youtube.com/watch?v=4AGFuIOZaL0

II. Persona

Give the AI a persona to work with and a style of writing such as, for this we want it to act as a scribe, like a paralegal might. We probably don’t want to ask it to act like a lawyer because it will sound far too legalistic.

https://www.youtube.com/watch?v=4AGFuIOZaL0

Prompt:

Imagine you are a paralegal professional assisting in drafting a social disadvantage narrative.

Your job is to help an individual claiming social disadvantage to present facts and evidence that by themselves establish that the individual has suffered social disadvantage that has negatively impacted his or her entry into or advancement in the business world.

If you understand and can fulfill my request simply say yes and nothing more

III. Context

Tell the AI everything it needs to know to inform it’s writing, fortunate for us, they gave us a pile of requirements that we can reformat and pass to the AI.

Prompt:

SBA considers such factors as unequal access to credit or capital, acquisition of credit or capital under commercially unfavorable circumstances, unequal treatment in opportunities for government contracts or other work, unequal treatment by potential customers and business associates, and exclusion from business or professional organizations.

Each instance of alleged discriminatory conduct must be accompanied by a negative impact on the individual's entry into or advancement in the business world in order for it to constitute an instance of social disadvantage.

SBA may disregard a claim of social disadvantage where a legitimate alternative ground for an adverse employment action or other perceived adverse action exists and the individual has not presented evidence that would render his/her claim any more likely than the alternative ground.

SBA may disregard a claim of social disadvantage where an individual presents evidence of discriminatory conduct, but fails to connect the discriminatory conduct to consequences that negatively impact his or her entry into or advancement in the business world.

In determining whether an individual claiming social disadvantage meets the requirements, SBA will determine whether:

(i) Each specific claim establishes an incident of bias or discriminatory conduct;

(ii) Each incident of bias or discriminatory conduct negatively impacted the individual's entry into or advancement in the business world; and

(iii) In the totality, the incidents of bias or discriminatory conduct that negatively impacted the individual's entry into or advancement in the business world establish chronic and substantial social disadvantage. Business history – SBA considers factors such as: unequal access to credit or capital; acquisition of credit or capital under commercially unfavorable circumstances; unequal treatment in opportunities for government contracts or other work; unequal treatment by potential customers and business associates; and exclusion from business or professional organizations.

So be detailed and articulate in describing the disadvantage but do not editorialize, I will now give you the requirements for the document, if you understand and can fulfill my request simply say “I understand” and nothing more

IV. Constraints

Now lets tell the AI how it needs to write so that it’s output is compliant with the requirement laid out by the SBA

Prompt:

The Small Business Administration stipulates that a social disadvantage narrative must include the following elements:

1. At least one objective distinguishing feature that has contributed to social disadvantage, such as race, ethnic origin, gender, physical handicap, long-term residence in an environment isolated from the mainstream of American society, or other similar causes not common to individuals who are not socially disadvantaged;

2. The individual's social disadvantage must be rooted in treatment which he or she has experienced in American society, not in other countries;

3. The individual's social disadvantage must be chronic and substantial, not fleeting or insignificant; and

4 The individual's social disadvantage must have negatively impacted on his or her entry into or advancement in the business world. SBA will consider any relevant evidence in assessing this element, including experiences relating to education, employment and business history (including experiences relating to both the applicant firm and any other previous firm owned and/or controlled by the individual), where applicable.

So be certain to articulate these factors, I will now give you the format for the document, if you understand and can fulfill my request simply say “I understand” and nothing more.

V. Format

Now we need to stipulate exactly how we want the AI to output the narrative, again the SBA gives us detailed instructions:

Prompt:

For each incident, please describe who, what, where, why, when, and how discrimination or bias occurred. Incidents are more easily digested by the SBA if they provide information in the following order:

When – Explain when the discriminatory conduct occurred. Exact dates, if available, are preferred but are not necessary so long as the incident provides a specific time period. This discrimination can be from any period of your life; you do not need to be experiencing current discrimination to qualify.

Where – Explain where the discriminatory conduct occurred. The incident must have occurred in American society.

Who – Explain who committed the discriminatory action. This could include an individual, a group of individuals, or an institution. Individual names, where available, are preferred but not necessary so long as the incident provides a specific figure or organization.

What – Explain the discriminatory conduct.

Why – Explain the reason(s) that the conduct was more likely motivated by bias or discrimination than other non-discriminatory reasons. Without additional facts, a mere assertion that the action was the result of bias or discrimination is not enough to support a claim of social disadvantage.

How - Explain how each instance of discriminatory conduct impacted your entry into or advancement in the business world. Offensive comments or conduct, while reprehensible, will not support a claim of social disadvantage if there is no negative impact associated with the incident.

So be certain to articulate these factors, I will now give you the format for the document, if you understand and can fulfill my request simply say “I understand” and nothing more.

VI. Case

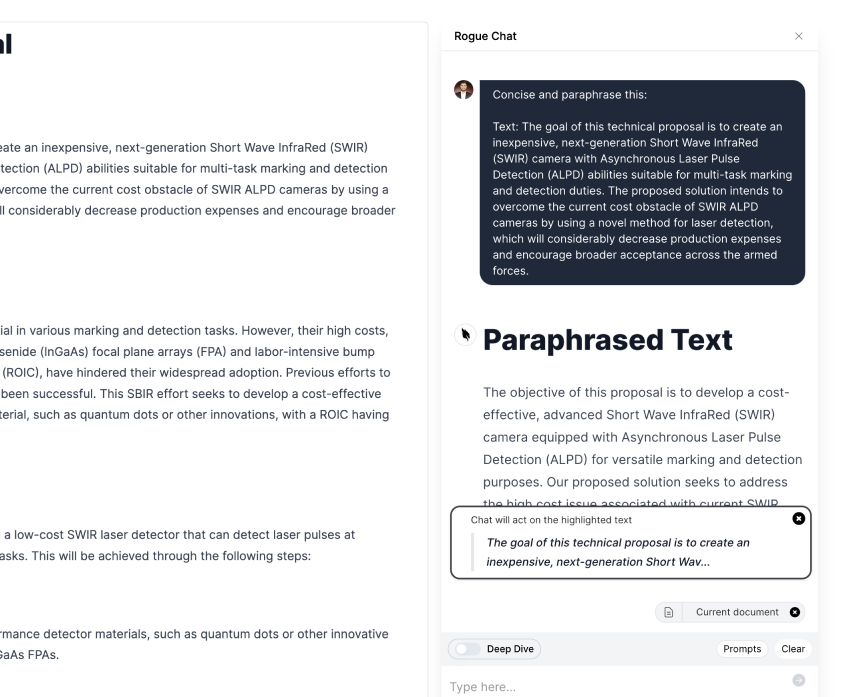

Instances of social disadvantage are serious and personal events, and using even a case study of real events for this exercise would be a disservice to those who experienced them. Instead we will use a relevant and well-founded example that is representative of know facts, such as the disparity of PPP loan amounts during the COVID-19 pandemic, as referenced by Bank Rate. Thus we will use a representative but fictitious example of disparate treatment in loan approvals.

❗This is the part where you need to articulate your instances and experiences of social disadvantage, replace the details below with your actual details.

Prompt:

<insert below here>

Acme Corp. is owned and operated by Janice Smith is a minority woman-owned professional service business that provides program, project, financial and administrative management services for the Federal Government. Acme employs 50 people with an average monthly payroll of $105,000.

On March 5th 2021, Janice applied for a PPP loan in the amount of $262,500 per the SBA instructions at 1st Acme Bank and Trust.

A typical PPP Loan amount = 2.5 * average monthly payroll costs, thus Acme applied for a loan of $262,500, they received a loan of only $200,000.

The loan officer, Walter Scott cited that Acme Corp. has fluctuations in payroll and he used an average of monthly payrolls to calculate the

The delta of $62,500 equates to the monthly payroll of 7 employees, for whom Janice had no PPP loan coverage, an undue hardship that other businesses did not have to undergo.

<insert above here>

Your next task is to write a compliant social disadvantage narrative given the instructions I provided thus far. If there is any missing information based on the SBA instructions please ask me for it now and allow be to provide it to you, if I provided sufficient information to write a compliant social disadvantage narrative then simply ask if you should proceed.

https://www.youtube.com/watch?v=v13epZCod3Q

All you have to do is type “yes”.

If you want it to be in your voice, you can follow up with a final prompt:

Prompt:

Rewrite this verbatim but in a first-person voice.

Practical Exercise

- Try it for yourself, see if it works well for you.

- Give some feedback in the group on whether you think the AI was effective.

- Give feedback below

GovCon GPT Masterclass

31 lessons

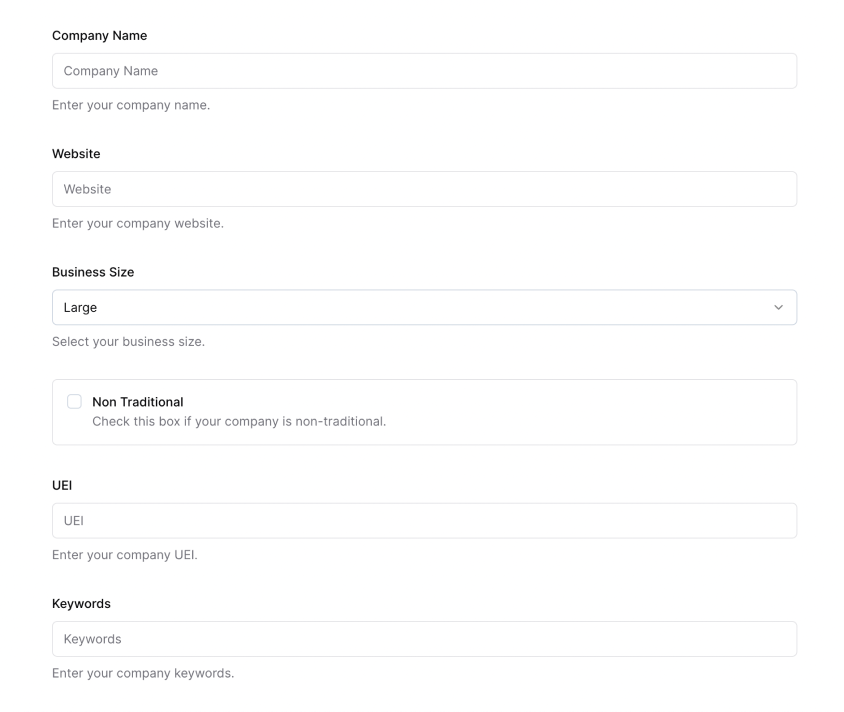

Sign up for Rogue today!

Get started with Rogue and experience the best proposal writing tool in the industry.